WP: How to achieve 400 UPH with Locus Fast Pick

WP: How to achieve 400 UPH with Locus Fast Pick Download Now!

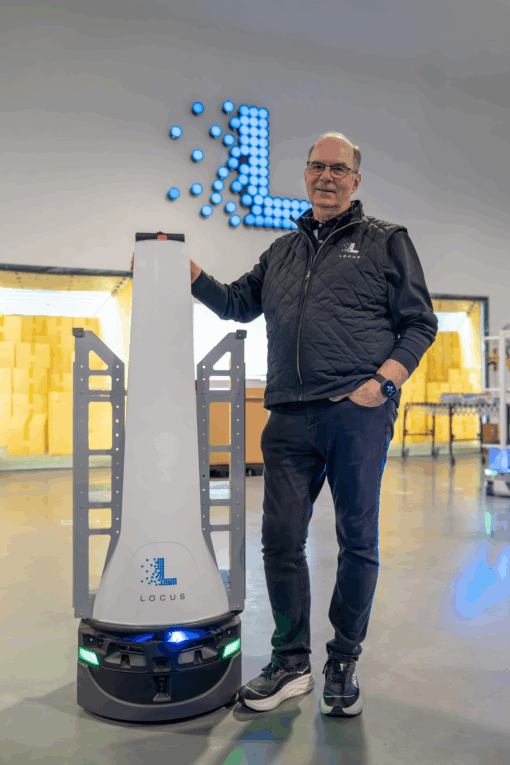

Rick Faulk, CEO Locus Robotics

As the CEO of Locus Robotics, I often get asked a very simple question by supply chain executives, operators, analysts, press and investors.

Is deploying warehouse robotics to automate piece picking for fulfillment operations at an inflection point?

My answer is “absolutely not.” That might surprise you.

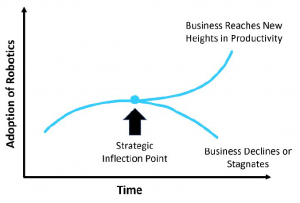

Inflection points classically occur when there is a fundamental change in how technology achieves some goal or how you use that technology for some type of gain. These changes, of course, can profoundly affect entire industries such as logistics.

Using warehouse robotics to improve today’s fulfillment industry is not at a simple inflection point. I believe it’s at a “Strategic Inflection Point” (SIP).

An SIP is much more powerful and important than simply an inflection point. A company’s ability to recognize and respond to a SIP can mean the difference between becoming a huge winner or a historical footnote. The SIP for robotics in logistics is now. It’s a time period when 3PLs, e-Commerce and B2B operators must respond to the disruptive change in the business environment or face deterioration.

An SIP is much more powerful and important than simply an inflection point. A company’s ability to recognize and respond to a SIP can mean the difference between becoming a huge winner or a historical footnote. The SIP for robotics in logistics is now. It’s a time period when 3PLs, e-Commerce and B2B operators must respond to the disruptive change in the business environment or face deterioration.

We recently conducted a Locus demo and presentation for 30 supply chain executives with a very large global brand. After our presentation, one of the executives got up and spoke to his team. His opening statement was a quote from Gartner analyst Debra Hoffman: “Traditional supply chain strategies that focused on incremental change, being risk-averse, and that are measured mostly on cost savings and efficiencies, will no longer win.”

I just returned from a trip to Europe where I met with the executive team from one of the country’s largest retailers. They are faced with a new Amazon building going up across the highway. He said he arrives to work every day knowing his biggest challenge is Amazon advertising they are hiring 2,000 workers at higher wage rates.

Comments like these indicate the pressure supply chain executives are feeling to innovate to effectively respond to increased competition, labor challenges, and demands from customers.

Based on market feedback, observations, and facts, let’s examine the 8 Factors that have created the SIP driven by collaborative robotics. Although many of the data points mentioned below are from the United States, these 8 Factors are relevant to the supply chain globally. Each of the 8 Factors below have their own unique implications in Europe, Asia and other markets around the globe.

1. The Amazon Effect Has Created a Robotics Arm Race.

The “Amazon Effect” can mean different things to individual segments of the economy. For better or worse, the global economy is in the cross hairs of the Amazon Effect. Simply put, it’s a term used to describe Amazon’s success, which has changed the retail segment and customer expectations, both online and offline.

Amazon’s delivery network is a logistics marvel that allows room for the delivery of virtually any consumer good to the doorstep in a matter of days or even hours. E-Commerce providers and 3PLs are under increasing pressure to match Amazon’s speed, cost efficiencies, and accuracy.  A 2018 study found that 43 percent of consumers surveyed expected “much faster” delivery times, a sharp increase from 2017. A recent Deutsche Bank analysis of Amazon’s operations estimated that, at each location where they operate robots, the company saves as much as $22 million.

A 2018 study found that 43 percent of consumers surveyed expected “much faster” delivery times, a sharp increase from 2017. A recent Deutsche Bank analysis of Amazon’s operations estimated that, at each location where they operate robots, the company saves as much as $22 million.

3PLs are finding their clients are demanding contracts with service levels and economics that mirror what Amazon can deliver to the market. Both 3PLs and progressive retail operators have formed innovation teams within their operations to specify robotics solutions to compete. Leading companies such as DHL are establishing customer-facing innovation centers. Leadership teams are in many cases being goaled to deploy automation.

Locus is working in partnership with many of the large vendors such as DHL and JDA to display collaborative robotics within their innovation centers. Collaborative robotics are at the heart of their visions and solutions for their customers.

Bottom line, with the acquisition of Kiva and the deployment of warehouse robotics, Amazon created an “arms race.” 3PLs, B2B and e-Commerce executives need to “arm to compete.” Locus is an arms dealer in the arms race.

2. The Growth Trends in e-Commerce Will Create the Mandate to Automate.

With e-Commerce sales approaching and soon surpassing 10% of total retail sales and growing, how and where purchases get made are forever changed. Online purchases will only become more a part of everyday life. When making a purchase decision, consumers increasingly gravitate online because they know they can order a product and have it at their doorstep within a day or even a few hours.

With e-Commerce sales approaching and soon surpassing 10% of total retail sales and growing, how and where purchases get made are forever changed. Online purchases will only become more a part of everyday life. When making a purchase decision, consumers increasingly gravitate online because they know they can order a product and have it at their doorstep within a day or even a few hours.

The growth in e-Commerce is also being fueled by the unprecedented use of smartphones. Recent studies indicate that more than 40% of Black Friday’s e-Commerce business was conducted on a mobile device.

Both large and small organizations are seeing significant growth in their online business. For the most recent holiday quarter, Walmart reported earnings and revenue that topped analysts' expectations, as its e-Commerce sales surged 43%.

These growth trends in e-Commerce are putting pressure on traditional supply chains to automate with robotics, both to scale and to meet the demands of seasonal peaks. Several progressive operators are also considering vertical distribution centers equipped with robotics. These distribution centers are typically located next to major metropolitan areas, which allow goods to be closer to consumers and enable 3PLs and retailers to deliver orders inexpensively and more effectively differentiate their services.

3. The Labor Challenge in the Supply Chain has Moved from a “Gap to a Crisis.”

Very simply, 3PLs cannot find enough warehouse workers to meet their Service Level Agreements (SLAs). e-Commerce operators cannot find enough workers to ship what they sell. It’s now at the crisis stage and it’s getting worse.

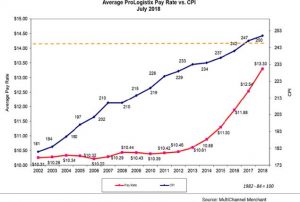

The crisis is exacerbated by increases in wage rates for warehouse workers.

As detailed in the chart, distribution center wages for warehouse workers were basically flat from 2002 through 2013 before starting to see a rapid increase. This increase has intensified as a result of the recent Amazon wage hike to $15 per hour.

At Locus, we have conversations regularly with clients where fully loaded wage rates for warehouse associates are at the $20-$25 per hour level due to high demand, Amazon, and legislation increasing the minimum wage rate. We have seen some wage rates as high as $40 per hour for warehouse associates. There are selected markets such as Mexico and Brazil where wage rates have not increased to a level to justify automation. Historical data would suggest increases in wage rates will begin to parallel the growth of e-Commerce in these markets.

Turnover is also a factor aggravating the labor crisis. Many facilities report turnover to be in double digits a month. Turnover can be even higher during seasonal peaks, threatening SLAs and increasing costs. For many 3PLs, the massive volume of orders during peak season often creates operational losses due to high turnover, training costs, recruiting fees, and shipping fees due to missed SLAs. With turnover so high, training of new hires must be able to be done very quickly.

Longer-term macro demographic and economic trends point to the fact this crisis will persist and most likely only be relieved with automation solutions such as collaborative robotics from Locus.

Longer-term macro demographic and economic trends point to the fact this crisis will persist and most likely only be relieved with automation solutions such as collaborative robotics from Locus.

Overall, warehouse employment has risen 50% from 2014 to 2018 according to the Bureau of Labor Statistics. This trend line shows no sign of flattening. Nearly every geography I visit, I’m told by customers and prospects that the local unemployment has dipped below 3% or less. This is just another macro-economic trend exacerbating the labor issue for distribution centers.

The labor market is also undergoing a double transition that will impact warehouse operations. First, there’s an overall aging of the workforce. Second, millennials are becoming the largest percentage of the workforce population. According to the Bureau of Labor Statistics the median age of a warehouse worker is 37.7, which is almost five years younger than overall median age of the entire workforce population.

Working alongside warehouse robots becomes a very useful recruiting and retention tool for both younger and older populations (the latter will need to be tapped as labor shortages become more severe). The cutting-edge technology, intuitive user interface, gamification potential and reduced physical stress when using the LocusBot are easy selling points to both populations.

4. The Need for Operational Flexibility & Scalability is Strategic.

Today’s progressive operators don’t want to have to “bolt down” any physical structure. They want to maintain operational flexibility to move assets around in a facility when demanded by “changes” in the business. These changes could be driven by increased/decreased volume, change in client/product mix or a move to a new facility. Automation solutions need to be flexible and be able to move from facility to facility with ease.

Most retailers we work with have told us that the business mix (store vs. wholesale vs. e-Commerce) has changed dramatically over the last 3 years. Fixed infrastructure is not only undesirable but represents for many operators a potential strategic disadvantage in the ever-changing world we live in.

The client mix for 3PLs is subject to constant change. The amount of capital required to start an online business has dropped significantly over the last 10-20 years. There are thousands of new businesses being started every year that sell physical goods that will add to the demands of the logistics sector. The success of platforms like Etsy, Kickstarter, et. al. highlights this phenomenon.

It means that the client list of a 3PL is going to be ever changing as new businesses take off and others fizzle out, which means that the 3PL is going to be constantly re-configuring warehouses to make room for new customers, move high volume customers to key slots, and change out older customers.

It also means that established/incumbent brands will need to take a hard look at their value proposition to the customer to stay competitive – whether it’s improving customer service (e.g., faster shipping times), or lowering price points (e.g., wringing out costs to maintain margins) – the warehouse/distribution center becomes a key cog in that machine. Being able to scale to handle the demands of peak is critical for success. Facilities can see a 5-10X increase in unit volume during peak periods.

Collaborative robotics solutions such as Locus can be easily reconfigured to accommodate the demands for flexibility and scalability.

5. There is Acceptance of Collaborative Robotics in the Workforce.

Some people fear that robots or full automation may someday take their jobs, but this is simply not the case. In general, across all aspects of our society, there is a growing acceptance that robots will enhance our economy and human performance – from factories to critically sensitive surgical procedures.

Warehouse robots bring more advantages than disadvantages to the warehouse and, more broadly, to the workplace. They enhance a company’s ability to succeed while improving the lives of real, human employees who are still needed to keep operations running smoothly. Robots dramatically improve the ergonomics of the warehouse. Robots certainly can’t do everything, particularly in a warehouse. Some jobs, such as picking an item from a bin, are more

Warehouse robots bring more advantages than disadvantages to the warehouse and, more broadly, to the workplace. They enhance a company’s ability to succeed while improving the lives of real, human employees who are still needed to keep operations running smoothly. Robots dramatically improve the ergonomics of the warehouse. Robots certainly can’t do everything, particularly in a warehouse. Some jobs, such as picking an item from a bin, are more

efficiently completed by a human.

In a collaborative robot environment, humans work with robots in the same space, therefore efficiency is greatly increased. Locus results show that in such a collaborative “environment” a human will have double the efficiency. Job satisfaction increases as associates will walk significantly less and no longer be required to push heavy pick carts.

In many Locus-enabled facilities, the robots are looked at as co-workers not as competitors. The robots even have names! The LocusBots are working with people, not in place of them. The new generation of service robots such as Locus are sharing the same space and tasks with humans.

6. Retail is Changing; Omnichannel is Here to Stay and Guideshops are Emerging.

One of the benefits e-Commerce retailers are seeing is implementing omnichannel marketing. They are creating a consistent experience for customers across multiple platforms.

For example, a consumer can download a retail app at home, become a subscriber on the train, and then activate the resulting discount when ordering a shirt at a web site. Multiple channels are involved, but the customer is getting one, seamless experience. Oh yes, and that order needs to be picked, packed and shipped to the store by noon for pick-up by the customer.

For example, a consumer can download a retail app at home, become a subscriber on the train, and then activate the resulting discount when ordering a shirt at a web site. Multiple channels are involved, but the customer is getting one, seamless experience. Oh yes, and that order needs to be picked, packed and shipped to the store by noon for pick-up by the customer.

Another theme with Omnichannel is that we are seeing smaller but more frequent retail replenishment orders. These are very similar to large e-Commerce orders. A store essentially sells a unit and gets a replacement unit the very next day. This enables them to keep a small or non-existent backroom while still maintaining broad style/color/size availability for their customers. Omnichannel is not just a buzzword … it’s here to stay.

Guideshops, such as those from Bonobos, are another emerging trend in retail. Guideshops are small footprint retail outlets in high traffic areas. These “try on and buy” retail environments are driving a significant number of e-Commerce orders that need to be quickly fulfilled. By design, smaller stores don’t carry large inventory, driving the entire operation towards a more e-com-like process. This translates to more labor to fulfill the same output levels. The two new retail strategies are putting increased pressure on the backend warehouse facility to process orders much faster. It also requires sophisticated algorithms to determine how to most effectively pick and process orders.

Guideshops, such as those from Bonobos, are another emerging trend in retail. Guideshops are small footprint retail outlets in high traffic areas. These “try on and buy” retail environments are driving a significant number of e-Commerce orders that need to be quickly fulfilled. By design, smaller stores don’t carry large inventory, driving the entire operation towards a more e-com-like process. This translates to more labor to fulfill the same output levels. The two new retail strategies are putting increased pressure on the backend warehouse facility to process orders much faster. It also requires sophisticated algorithms to determine how to most effectively pick and process orders.

7. Lower Cost of Technology & Machine Learning Enable the Value Proposition.

A few years ago, you could not have designed and manufactured a collaborative robot and sold it at a price which justified the value proposition. Lidars and sensors were simply too expensive.

Thanks to Tesla and others in the auto industry, the cost of the sensor suite has been significantly reduced. Innovative operators can now achieve a very high ROI due to the reduction in overall costs for robotics vendors such as Locus.

These cost reductions have also allowed solution developers such as Locus to offer subscription programs with no upfront capital commitment for the warehouse operator. This speeds the adoption curve and minimizes the risk.

Technology advances in machine learning and big data over the last 3-5 years have also enabled functionality to provide operators with data never-before visible, and management tools never- before available. Warehouse operators can use these tools to better manage their labor and reduce their costs. Managers from Locus-enabled sites can even view statistical and operational data on their smartphones.

8. Innovative Global Brands Have Moved from POCs to Full Scale Deployments in Multiple Facilities.

Those deploying collaborative robotics in their e-Commerce and B2B facilities today are seeing tangible ROI. They are seeing cost savings from higher UPH rates and faster training time. They are reducing cycle times for both e-Commerce and store replenishment. And they are seeing these benefits within a few weeks after deployment. These tangible results have driven deployments in multiple facilities within their operations.

You might want to watch this short video. Or check out the experiences of some Locus customers, by visiting our online video library.

So, what’s the “point?”

Cell phones created a simple inflection point in the telecom industry. Then smartphones in turn, created a Strategic Inflection Point for the entire mobile industry and personal computing. Because of the available apps, smartphones also disrupted PDAs, pocket cameras, MP3 players, calculators, camcorders, and GPS devices, to name just a few. These businesses are all dying.

We have reached the Strategic Inflection Point with collaborative robotics for warehousing. It’s truly disruptive. If Locus has anything to do with it, you will soon see armies of robots spreading throughout warehouses around the world, as the accelerating pace of automation transforms the industry and addresses the operational challenges.

What does it mean for you? Those who innovate with robotics will not only survive … they will thrive!

About the Author

Rick leads the executive team with over 30 years of experience in executive management, sales, and marketing for some of the world’s most successful technology companies, such as Cisco, Intronis, j2 Global, WebEx, Intranets.com, Barracuda Networks, Lotus Development, Mzinga, and PictureTel. Rick leads the executive team and is responsible for the overall strategy and execution at Locus Robotics. Rick currently sits on various boards and is an advisor to multiple companies, including Retrocausal, Arccos, Cybernetix Ventures, and Leading Edge Ventures. Past board positions include Yodle, Virtual Computer, Bidding for Good, Skill Survey, Influitive, Ntirety, Blue Raven, and Centive.